"`html

International transactions expose companies to particular risks. Between the time when goods leave the country and the time when payment is received, a number of events can jeopardise the company's business.commercial operation.

Political risks or 'country risks

Political risk, now commonly referred to as "country risk", is a specific feature of export transactions. It can take various forms.

Conflicts and social unrest

The occurrence of war, revolution or popular unrest in the country of destination may prevent performance of the contract or payment of the debt. These events, by their very nature unpredictable, paralyse commercial transactions and often make it impossible to recover sums due.

Case law has gradually broadened this concept to include large-scale strikes and social unrest that significantly disrupt a country's economic activity.

Government decisions

Measures taken by the authorities of a foreign state may jeopardise the performance of international contracts. Article R. 321-1 of the Insurance Code makes a specific distinction betweenexport credit insurance of general insolvency insurance to take account of this particularity.

These decisions can take several forms:

- Nationalisation of companies

- Confiscation of property

- Introduction of import quotas

- Regulatory changes affecting the performance of the contract

- Currency transfer restrictions

A typical example is the introduction of exchange controls preventing the repatriation of payments to the exporting country.

Failure of public purchasers

Unlike in the domestic market, claims on foreign public bodies are considered to be covered by political risk. As the doctrine points out, "as the public purchaser is considered to be solvent, its economic deficiencies fall within the scope of political risk" (Nicolas V., Fasc. 800: Internal and export credit insurance).

This qualification plays a decisive role in the cover provided by credit insurance organisations, in particular Coface.

Commercial or insolvency risks

L'export credit insurance also covers commercial risks similar to those encountered on the domestic market.

Insolvency of private buyers

This risk corresponds to "serious financial difficulties on the part of the private buyer who can no longer honour its debt(s)" in the context of a contract spread over time.

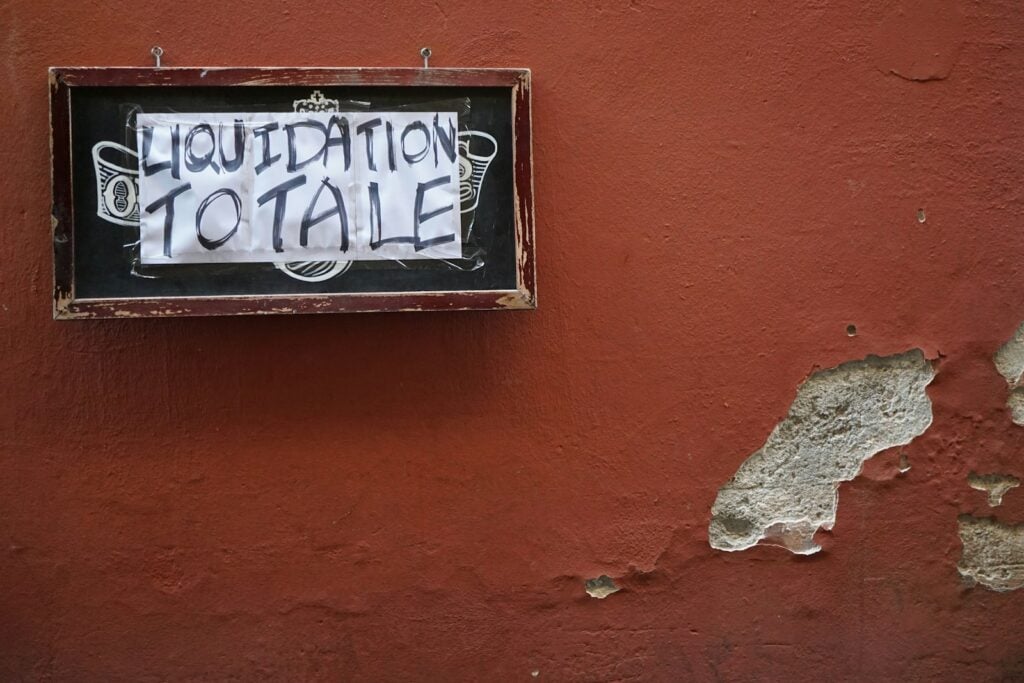

There is one particularity that deserves attention: being placed in compulsory liquidation is not an imperative condition for triggering cover. Credit insurance policies generally adopt a broad concept of insolvency, which is less strict than that of insolvency law.

Distinction from political risk

The dividing line between commercial and political risk can sometimes seem a fine one. Can a situation of widespread insolvency in a country be classified as a political risk? The question divides the doctrine.

The main distinguishing criterion is the origin of the failure:

- If it arises from difficulties specific to the debtor company: commercial risk

- If it results from macroeconomic conditions or political decisions: country risk

Alternative risk classifications

The traditional analysis distinguishing between political and commercial risks is not the only relevant approach.

Provisional risks vs. definitive risks

This classification is based on whether the failure is temporary or permanent:

- Temporary risk failure to pay on the due date, without this constituting definitive insolvency

- Definitive risk irremediable insolvency of the debtor

This distinction has important practical implications. A provisional risk is more akin to a cash flow problem, whereas a definitive risk corresponds to an outright loss.

Risk of loss vs. risk of contractual interruption

Another approach is to distinguish between :

- Risk of direct loss non-recovery of a debt

- Risk of contractual interruption loss resulting from the premature termination of a partially performed contract

In the latter case, the exporting company may have invested heavily and refused other contracts. The loss then includes not only the sums not recovered but also a substantial loss of profit.

Scope and limits of cover

The cover offered byexport credit insurance has a number of specific features.

Goods and services concerned

The guarantee can cover a wide range of transactions:

- Sale of heavy capital goods

- Supply of light equipment

- Services (maintenance, technical studies)

- Works contracts

There is no a priori limitation on the nature of the goods or services that can be covered. However, the conditions of insurability vary from sector to sector and from country to country.

Usual exclusions

Credit insurance policies generally contain exclusions. Article L. 432-2 of the French Insurance Code, amended by the Supplementary Finance Act no. 2001-1276 of 28 December 2001, specifies the limits of the cover that may be granted by the French State.

Typical exclusions are

- Consumer credit

- Contracts with individuals

- Companies already in suspension of payments

- Subsidiaries or companies controlled by the policyholder

As a result of changes in European law, the State is no longer responsible for short-term political risks within the European Union.

Company directors should pay particular attention to these exclusions when negotiating credit insurance policies. Prior analysis of the specific risks associated with each export transaction will help optimise cover.

Our teams specialising in international trade law can help you support this strategic approach. Contact us for a personalised analysis of your credit insurance needs.

Sources

- Insurance Code, articles L. 432-2, L. 432-3 and R. 321-1

- Nicolas V., "Assurance-crédit interne et à l'exportation", JurisClasseur Droit bancaire et financier, Fasc. 800, 31 August 2005.

- Supplementary Finance Act No. 2001-1276 of 28 December 2001

- Directive no. 87/343 of the Council of the European Communities of 22 June 1987 (OJEC no. L 185, 4 July 1987)

- Court of Cassation, 1st Civil Chamber, 11 November 1992 (Bull. civ. 1992, I, no. 279)

" `