A creditor who initiates proceedings for the seizure of property must notify the registered creditors. To this end, they must denounce the order to pay as a seizure of property. The act of denunciation contains compulsory information of its own. It is equivalent to a summons to appear at the orientation hearing.

The legality of the procedure may be compromised if the denunciation is not carried out validly. Here's where we stand.

What is a registered creditor?

Definition of registered creditor

A registered creditor is a creditor whose claim is secured by a mortgage registration. This includes registrations of lender's privileges, published by banks, and all types of mortgages.

This is why they are also known as mortgagees.

Identifying registered creditors

Registered creditors will be identified by means of a mortgage statement. The pursuing creditor can order this document from the Land Registry using CERFA form no. 3233-SD.

Date of mortgage registration

The procedure does not have to be notified to creditors whose registration is pending.

The Land Registry processes publication requests in two stages. First, the department analyses whether the request contains any grounds for refusing publication.

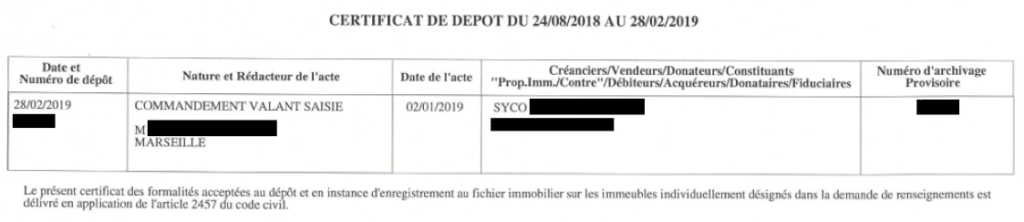

If the deed contains no grounds for refusal, it is given a provisional archive reference. On the property record, it then appears under the box "Certificate of deposit :

The department will then analyse the reasons for publication rejection.

If the publication is accepted on publication, it will be registered on the initial date.

The list of reasons for publication refusal and rejection can be found at article 34 of the decree of 4 January 1955 reforming land registration. We have already dealt with this point in publications dedicated to identification of individuals and buildings in deeds published in the property register.

The two stages of analysing the reasons for refusal and rejection are often separated by several months. In the meantime, the deed is awaiting registration.

Where a mortgage is pending registration at the time the notice of seizure is to be served, it does not have to be taken into account. The seizure of property does not have to be denounced to creditors whose hypothec is pending registration (Cass. civ., 2e, 10 April 2014, no. 13-13.770).

The deadline for notifying mortgagees of the summons

Article R. 322-6 of the French Code of Civil Enforcement Procedures states that :

"No later than the fifth working day following the delivery of the summons to the debtor, the summons to pay valid as a seizure is notified to the creditors registered on the day of publication of the summons.

The notification is equivalent to a summons to appear at the orientation hearing.

The denunciation must be made within a maximum of 5 days from the date of the summons to the orientation hearing. This time limit applies if the summons to pay for the seizure of the property is not complied with.

Scheme of procedure up to denunciation to registered creditors

Notification of denunciation

The statement of claim must be notified to the pursuing creditor and the debtor.

Notice to the pursuing creditor will be given by a lawyer.

Notice to the debtor shall be given by a lawyer's deed if the debtor has incorporated a lawyer. Otherwise, it will be done by bailiff.

Details of the notice

Article R. 322-7 of the Code of Civil Enforcement Procedures lists the compulsory details of the notice of termination:

- The place, day and time of the orientation hearing.

- The summons to acquaint oneself with the conditions of sale.

- Indication of the hammer price.

- The summons to declare the debts registered on the seized property. The declaration must be made in principal, costs and accrued interest. The rate of default interest must be indicated. The writ of execution and the registration slip must be filed with the court registry.

- Penalties for failure to declare a claim. The registered creditor loses the benefit of his mortgage ranking.

- Deadline for lodging a claim: 2 months from the date of notification.

- How to challenge the decision: through legal submissions.

Penalties for failure to give notice of termination

A registered creditor who has not declared his claim in good time is downgraded to unsecured status.

What does this mean? The foreclosure procedure ends with the distribution of the sale price to the registered creditors. Payment is made according to mortgage ranking.

If a registered creditor does not declare his claim, he is no longer paid according to his rank. They are placed in competition with creditors who have not registered a mortgage. The balance of the sale price is divided between them on the basis of the euro mark.

The place of denunciation

Article R. 322-8 of the French Code of Civil Enforcement Procedures states that "Notice to registered creditors may be given at the addresses indicated on the registration forms.

It may be made to the heirs collectively without designation of their respective names and capacities, at their elected domicile or, failing that, at the domicile of the deceased.

In practice, almost all mortgage registrations include an elected domicile. This means that the creditor is domiciled with the court officer (notary, bailiff, lawyer) who published the registration.

The proceedings may be domiciled at the creditor's elected domicile. This is not compulsory: the creditor may give notice at the registered office or at the address for service of process.

Frequently asked questions

Who are the registered creditors?

Registered creditors are creditors who have a mortgage registered against the property against which the seizure is being pursued.

What is the order of payment for creditors?

Creditors are paid according to their lien and mortgage ranking.

Who are the preferred creditors?

Preferential rights allow the creditor who benefits from them to be paid in priority, even if the mortgage has not been registered.