The seizure of a bank safe-deposit box is a complex procedure that involves the action and responsibility of many players: creditor, debtor and also the third party holder, the bank. This procedure, which is governed by strict rules set out in the Code of Civil Enforcement Procedures, makes it possible to recover a debt by seizing valuable assets held in safekeeping by a debtor. Whether the aim is to recover a sum of money, a specific object or to take security, each type of seizure is subject to specific conditions and formalities. This article details all of these procedures, their implications for each party in this type of case, and the recent developments that are shaping this area of expertise. To navigate these procedures, the assistance of an lawyer specialised in seizure procedures is often an essential tool for guaranteeing everyone's rights.

General framework and safe deposit box contract: a tripartite relationship

Before examining the seizure mechanisms, it is essential to understand the nature of the contractual relationship between a customer, whether an individual or a company, and his bank when renting a safe deposit box. This understanding is the key to understanding the full extent of each party's obligations when the courts intervene.

Legal nature of the safe-deposit box contract and the role of the bank

A safe deposit box hire contract is neither a simple lease nor a deposit contract. Case law classifies it as a service contract, and more specifically as a custody contract. This classification has important consequences. The banker, although unaware of the contents of the safe-deposit box, is bound by a very strict obligation of supervision, known as an obligation of result. The banker must guarantee the integrity and security of the safe-deposit box and can only avoid liability by proving force majeure or fault on the part of the customer. This monitoring obligation becomes central when a seizure action is initiated.

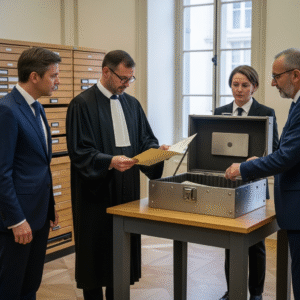

The key players in the safe seizure procedure

The procedure for seizing a safe involves three main parties. The creditor is the person who, armed with a title, seeks to recover his debt. The debtor is the holder of the safe deposit box rental contract, whose assets are the subject of this action. Lastly, the garnishee, generally a bank, is the custodian of the safe deposit box. Its role is not passive: it has obligations to inform and collaborate with the bailiff, while at the same time having to protect the interests of its client within the strict limits set by the law for this case.

Rules common to all seizures of assets placed in safes

Whatever their purpose, seizures of assets contained in a safe are subject to a set of common procedural rules designed to ensure that the measure is effective and that the rights of each party are respected. Although the seizure of safes involves movable property, it shares with other types of seizure a number of common procedural rules. enforcement proceedingsIn the case of property seizures, the need for a writ of execution and the central role of the Enforcement Judge, an essential guarantee tool.

Mandatory content of the bailiff's document

The procedure begins with the service of a bailiff's document on the third party holder, i.e. the bank. This document, governed in particular by article R.224-1 of the Code, contains a number of compulsory details, failing which it is null and void. It must precisely identify the debtor (name and address in the case of a natural person, name and registered office in the case of a company or legal entity) and refer to the title under which the seizure is made. The third party is also required to provide the bailiff with the identification of the safe concerned, an obligation that derogates from professional secrecy.

Prohibition of direct access and affixing of seals

The bailiff's writ contains a clear injunction prohibiting any access to the safe, except in the presence of the bailiff. As soon as this document is served, the safe deposit box is no longer freely accessible to the debtor. Any banker who fails to comply with this prohibition will incur civil liability towards the creditor. To reinforce this measure, the bailiff may affix a seal to the safe deposit box, a useful precaution if there is a risk that the debtor or a third party may attempt to gain unauthorised access.

Seizure and sale of safe-deposit box assets: detailed procedure

Seizure and sale is the most common enforcement procedure. Applied to a safe deposit box, the aim of this procedure is to sell the goods in the box and pay the creditor from the proceeds. It follows strict formalities, from the initial act to the actual sale of the objects seized.

From summons to pay to opening the safe

The seizure-sale procedure begins with the service of a summons to pay on the debtor, no later than the first working day following the act of seizure served on the bank. This document informs the debtor of the seizure, enjoins him to pay his debt and sets the date and time for opening the safe. A period of fifteen days must elapse between service of the summons and the actual opening. This period allows the debtor to pay the debt in full and have the seizure lifted. If the debtor does not pay, the seizure will take place on the date set, in the presence of the debtor or, in his absence, by force, in the presence of the banker or his representative. The costs of this forced opening are advanced by the creditor but remain payable by the debtor.

Inventory, removal and continuation of seizure and sale operations

Once the safe has been opened, the bailiff makes an inventory of the goods. If the debtor is present, the inventory may be limited to the assets required to cover the entire debt. If the debtor is not present, all of the assets in the safe are inventoried. The bailiff then distinguishes between assets that can be seized and those that cannot, such as personal or family mementos. Seized assets are immediately removed and placed in the custody of the bailiff or a receiver. The inventory deed must mention the possibility for the debtor to sell the goods out of court within one month. If the debtor fails to do so, the property sold will be compulsorily auctioned off.

Referral to the ordinary law rules on seizure and sale

Once the goods have been removed from the safe, the procedure continues in accordance with the rules governing seizure and sale under ordinary law. The provisions of articles R. 221-30 et seq. of the Code des procédures civiles d'exécution (see art. R. 221-30 C. pr. exéc.) govern the terms and conditions of the out-of-court sale, the forced sale and any incidents that may arise. The debtor regains free access to his safe, which becomes accessible again, emptied of the seized assets.

Seizure and attachment of safe-deposit box assets: conditions and stages

Unlike seizure for sale, which is aimed at obtaining a sum of money, the purpose of seizure and attachment is to recover a specific item of tangible property that the debtor is required to deliver or return. Although governed by specific rules for opening the safe, the seizure and attachment procedure is always aimed at obtaining the delivery or restitution of a specific item of tangible personal property.

Procedural specificities and order to deliver or return

The procedure begins in the same way, with a document served on the bank. However, the document served on the debtor is a "summons to deliver or return". This document must precisely identify the property claimed and summon the debtor to voluntarily hand it over before the date on which the safe deposit box is opened. If the property is located in a dwelling belonging to a third party, prior authorisation from the enforcement judge is required. The summons also warns the debtor that if he refuses or is absent, the safe will be forcibly opened at his expense.

Opening, inventory and removal times and operations

As in the case of seizure for sale, a period of fifteen days must be observed before the safe is opened, unless the debtor decides to return the goods voluntarily. Once the safe has been opened, the bailiff makes an inventory. If the debtor is present, the inventory is limited to the property seized. If the debtor is not present, all the items are inventoried to avoid any subsequent disputes. The property claimed is then immediately removed by the bailiff and handed over to the creditor. If the property is not in the safe, a statement of default is drawn up.

Seizure of safes: specific features and disputes

Attachment is a precautionary measure. This action enables a creditor whose claim has not yet been established by a writ of execution but appears to be well-founded, to make the debtor's assets unavailable in order to guarantee the future recovery of the debt in full. Before looking at the specifics of this procedure for assets placed in a safe deposit box, it is essential to understand the following the protective attachment mechanismThese include the conditions for authorisation by the judge and its future conversion into an enforcement measure.

Conditions for authorisation and service on the debtor

To carry out a protective attachment, the creditor must, apart from a few exceptions, obtain authorisation from the enforcement judge. The creditor must show that his claim is well-founded in principle and that there are circumstances likely to threaten its recovery. The writ of seizure served on the bank contains the same information as for other seizures, in particular the injunction to prohibit access. The debtor must then be notified of the measure within eight days, indicating his or her right to request that the measure be lifted if he or she considers that the conditions for validity have not been met.

Jurisdiction of the enforcement judge and appeal procedures

The territorial jurisdiction to rule on disputes relating to the precautionary seizure of goods in a safe presents a certain difficulty. In principle, the court with jurisdiction is that of the debtor's place of residence. The debtor may contest the seizure by requesting that it be released, for example if he considers that the claim is unfounded or that the circumstances threatening its recovery have not been established. The judge may then order the seizure to be lifted in whole or in part. The successful outcome of such a case often depends on a detailed analysis of the facts.

Opening the safe, inventory and conversion of the protective attachment

Unlike execution seizures, the safe is not opened systematically. It is only opened if the debtor so requests. The bailiff will then draw up a detailed inventory of all the assets that have been seized as a precautionary measure and placed in his custody or that of a receiver. Once the creditor has obtained a writ of execution, he can request that the protective seizure be converted into a seizure for sale or a seizure and attachment. The procedure then follows the rules applicable to these enforcement measures. This conversion action is a key stage.

Termination of the safe deposit box contract and impact of insolvency proceedings and overindebtedness

The seizure of a safe deposit box may interact with other complex legal situations, such as the termination of the lease by the bank or the opening of insolvency or over-indebtedness proceedings against the debtor.

Causes and procedure for terminating a safe deposit box rental contract

If, after a protective attachment has been made, the safe deposit box rental contract is terminated (for example for non-payment of rent), the banker must immediately inform the bailiff. The bailiff will then serve the debtor with a summons to attend to open the safe. If the debtor fails to appear, the safe can be opened by force after a period of fifteen days, and an inventory of the assets is drawn up in accordance with rules similar to those for seizure and sale.

The impact of insolvency proceedings and overindebtedness on safe seizures

The opening of receivership or liquidation proceedings against a debtor has a major impact: in principle, it brings all individual actions to a halt. A seizure for sale or attachment in progress is therefore suspended. The situation is more nuanced in the case of a protective attachment: if it was carried out before the date of cessation of payments, it may be maintained, but its conversion into an enforcement measure will be subject to the rules of collective proceedings, a complex matter. In a similar way to the seizure of property, the impact of over-indebtedness proceedings on a safe deposit box seizure can lead to the suspension of this action and the renegotiation of the entire debt under the aegis of the commission.

Third-party liability (bank) and protection strategies

The bank's role as third party holder is fundamental and it can be held liable if it fails to fulfil its obligations. The bank's responsibility as a third party holder is crucial; any failure to fulfil its information obligations can result in severe penalties, a principle that goes beyond the simple seizure of an account and is fully applicable here. Better understanding the garnishee's obligations is therefore essential for financial institutions.

Obligation to inform third parties and banking secrecy

As mentioned, the law requires the banker to cooperate with the bailiff. Article L. 123-1 of the Code of Civil Enforcement Procedures establishes a general obligation for third parties not to obstruct enforcement proceedings. In the case of the seizure of a safe, this translates into an obligation to provide the identification of the safe, thereby breaching professional secrecy. Any third party refusing to provide this information could be forced to do so, if necessary under penalty.

Penalties for non-compliance and scope of liability

Failure by the third party holder to fulfil his obligations can result in severe penalties. If they fail to comply with the injunction to prevent access to the safe, they may be held civilly liable and ordered to pay damages to the creditor if the latter suffers loss. Even more seriously, if the debtor refuses to make a declaration or makes an inaccurate or untruthful declaration, the court may order the debtor to pay the costs of the seizure, i.e. the full amount of the debt itself, without prejudice to additional damages for negligence.

Reform of civil procedure and future challenges for the seizure of safes

The law of civil enforcement procedures is constantly evolving. Recent reforms and new forms of property pose new challenges for safe seizure.

Main changes introduced by the 2019 reform and its implementing decrees

The reform of civil procedure, notably through the decree of 11 December 2019, has simplified and modernised several aspects of litigation. The creation of the tribunal judiciaire, merging the former tribunaux d'instance and tribunaux de grande instance, has unified the courts. The generalisation of the principle of de jure provisional enforcement of court decisions (see art. 514 of the Code of Civil Procedure) has also enhanced the effectiveness of titles obtained by creditors, enabling them to initiate enforcement measures such as safe seizure more quickly.

Current and future issues: unseizable assets, digital assets and developments in case law

The question of items that cannot be seized, such as family heirlooms, is of particular importance in the context of a safe, which is the preferred place of storage for this type of object. The bailiff and the judge must exercise discernment when making an inventory. The emergence of new types of property also poses legal challenges. The question of digital asset captureThis represents a major legal challenge, raising unprecedented issues of identification and apprehension. The law will have to adapt to provide an effective framework for the apprehension of these dematerialised assets.

Faced with the complexity of a safe seizure, whether you are a creditor, debtor or third party holder, the support of a law firm is essential to navigate the legal subtleties and protect your interests. Our firm is at your disposal to advise and assist you in these procedures.

Frequently asked questions

What is a writ of execution and why is it necessary for the seizure of a safe?

A writ of execution is a legal document (judgement, notarial deed) that officially recognises a debt and authorises any enforcement action. For enforcement actions such as seizure for sale or seizure of a safe, it is essential because it legitimises the bailiff's intervention and the attack on the debtor's assets.

Can the bank refuse to give information about its customer's safe deposit box to the bailiff?

No, the law requires the bank, as third party holder, to cooperate with the bailiff. In particular, it must provide the identification of the safe deposit box. Banking secrecy cannot be invoked in this context, and refusal would expose the bank to severe penalties.

What happens if the debtor is absent on the day the safe is opened?

If the debtor is absent, the bailiff can open the safe by force. This operation must take place in the presence of the banker or his representative. The debtor must pay all the costs of the forced opening, even if they are advanced by the creditor.

Can all the goods found in the safe be seized?

No, some assets cannot be seized. Particular attention must be paid to items that are necessary for the life and work of the debtor and his family, as well as items of a personal or family nature such as souvenirs. The bailiff must make a selection during the inventory to exclude these items from seizure.

How do I contest a safe deposit box seizure?

The debtor can challenge the seizure before the enforcement judge (JEX). The grounds for challenge may relate to the validity of the writ of execution, compliance with the procedure (time limits, compulsory information) or the seizability of the assets. In the case of a protective attachment, the dispute may also relate to the validity of the debt or the existence of threats to its recovery.

What happens to the safe once it has been seized?

Once the seized assets have been removed, the safe deposit box once again becomes fully accessible to the debtor. The rental contract with the bank continues as normal, unless it is terminated for other reasons, such as non-payment of rental fees.