"`html

Commercial relationships expose your company to the risk of non-payment. A customer in difficulty, a partner in default, an insolvent subcontractor - these situations threaten your cash flow. Personal guarantees are effective tools for securing your transactions. They oblige a third party to honour your debtor's commitments in the event of default.

French law offers three main mechanisms: the surety bond, the autonomous guarantee and the letter of intent. Their effectiveness varies considerably. Choosing the right guarantee can make all the difference between a successful recovery and an outright loss.

Guarantees: a traditional but regulated mechanism

Surety bonds remains the most widely used personal guarantee in France. Article 2288 of the French Civil Code defines it as "the contract by which a guarantor undertakes towards the creditor to pay the debtor's debt in the event of the latter's default".

An accessory mechanism

The essential characteristic of the guarantee is its ancillary nature. The guarantor cannot be liable for more than the principal debtor owes. This fundamental rule applies to both the scope and the terms of the undertaking.

The arm's length relationship with the principal obligation has direct consequences:

- The guarantor has the same defences as the principal debtor

- If the main contract is null and void, so is the guarantee

- Extinguishing the principal debt releases the guarantor

Order of 15 September 2021 has reinforced this accessoriality. The distinction between defences inherent in the debt and defences personal to the debtor has disappeared. The guarantor may now raise all defences against the creditor.

Forms of guarantee

The bond can be broken down into several variants:

- Simple guarantee: the guarantor may require the creditor to sue the principal debtor first (benefit of discussion).

- Joint and several guarantee: the creditor can approach the guarantor directly

- Guarantee certification: a guarantor guarantees the commitment of another guarantor

- Sub-guarantee: a person guarantees the guarantor's recourse against the principal debtor

Joint and several surety bonds, which provide greater protection for the creditor, are the most common form of surety in commercial practice.

Protection of the security deposit

The legislator has gradually strengthened the protection of guarantors, particularly individuals:

- The stringent formal requirements of Article 2292 of the Civil Code require a precise handwritten statement

- The creditor's obligation to provide annual information on the progress of the debt

- Limitations on the duration and amount of the bond

- Protection for guarantors in the event of the debtor's insolvency proceedings

These protections limit the effectiveness of the guarantee for the creditor. They explain the development of other forms of personal guarantees.

The stand-alone guarantee: a more robust alternative

The autonomous guarantee, enshrined in article 2321 of the Civil Code, has the same limitations as a surety bond. It is defined as "an undertaking by which the guarantor undertakes, in consideration of an obligation entered into by a third party, to pay a sum either on first demand or in accordance with the agreed terms".

Independence, the key to efficiency

Unlike surety bonds, autonomous guarantees are characterised by their independence from the main contract. This independence is its major strength:

- The guarantor may not invoke exceptions based on the basic contract

- Nullity of main contract does not affect guarantee

- Disputes between creditor and debtor do not prevent the guarantee from being activated

The guarantor undertakes to pay its own debt, separate from that of the principal debtor. This independence gives the creditor greater security.

First demand guarantee

In its most effective form, the autonomous guarantee is executed on first demand. The beneficiary obtains payment on simple written demand, without having to prove the debtor's default.

This guarantee discourages dilatory disputes. It enables the creditor to obtain the funds immediately, even if it means resolving commercial disputes at a later date.

The guarantor can only refuse to pay in two limited circumstances:

- Obvious abuse by the beneficiary

- Obvious fraud in the call on the guarantee

Case law interprets these exceptions very strictly, preserving the effectiveness of the mechanism.

Stand-by letters of credit

Stand-by letters of credit are an autonomous form of guarantee used in international trade. Issued by banks, they operate according to the same principles of autonomy.

These instruments, which are often subject to the uniform rules of the International Chamber of Commerce, offer considerable security in international transactions where risk assessment is more complex.

The letter of intent: between morality and law

A letter of intent, defined in article 2322 of the French Civil Code, is "an undertaking to do or not to do, the purpose of which is to support a debtor in the performance of his obligation to his creditor".

A wide range of commitments

The letter of intent covers a wide range of commitments:

- Mere moral comfort with no binding legal force

- Undertaking to act (maintaining an interest in a subsidiary)

- Undertaking not to do (not to dispose of certain assets)

- A performance bond similar to a surety bond

Its legal scope depends entirely on how it is worded. Hence the crucial importance of its drafting.

Advantages for the creditor

The letter of intent has a number of advantages:

- Its flexibility means it can be adapted to a variety of situations

- It may be issued by a parent company to its subsidiary

- It sometimes avoids the accounting constraints of surety bonds

- It can reassure trading partners without creating any binding commitments

The risks of ambiguity

Ambiguity is the main flaw in a letter of intent. Imprecise wording can lead to differing interpretations and disputes.

Case law scrupulously analyses the terms used to determine this:

- If there is a genuine legal commitment

- Whether the obligation is one of means or of result

- What is the exact scope of the commitment?

To be effective, the letter of intent must contain precise commitments and unequivocal terms.

Benchmarking your business

The choice between these different guarantees depends on a number of factors:

Comparison table

| Criteria | Bond | Stand-alone warranty | Letter of intent |

|---|---|---|---|

| Effectiveness for the creditor | Average | High | Variable |

| Set-up costs | Low | High | Low |

| Formalism | Strict | Moderate | Flexible |

| Enforceable exceptions | Many | Very limited | Variables |

| Resistance to insolvency proceedings | Low for individuals | Strong | Variable |

Selection criteria according to debtor profile

The profile of your debtor directly influences your choice:

- Established, reliable business: a surety bond may be enough

- Foreign or new partner: opt for the independent guarantee

- Solid parent company: letter of intent may be appropriate

- Debtor with fragile finances: demand an independent guarantee

The commercial relationship is also a factor. A guarantee that is too restrictive can jeopardise a budding relationship, while an insufficient guarantee exposes you to unnecessary risks.

Impact of insolvency proceedings

The protection offered varies considerably in the event of collective proceedings:

- Individual surety bonds: numerous safeguards (deadlines, discounts)

- The independent guarantee: maintaining the obligation to pay

- The letter of intent: effectiveness varies according to how it is drafted

Safeguard, receivership or liquidation proceedings are the ultimate test for a guarantee. The stand-alone guarantee stands up much better in these situations.

Practical applications

Some typical situations illustrate the relevant choices:

- Regular supply contract

- Recommended option: joint and several guarantee

- Reason: balance between protection and simplicity

- Large-scale international market

- Recommended option: independent first demand guarantee

- Reason: maximum security in an uncertain environment

- Financing a subsidiary

- Recommended option: specific letter of intent or stand-alone guarantee

- Reason: flexibility or security depending on the issues at stake

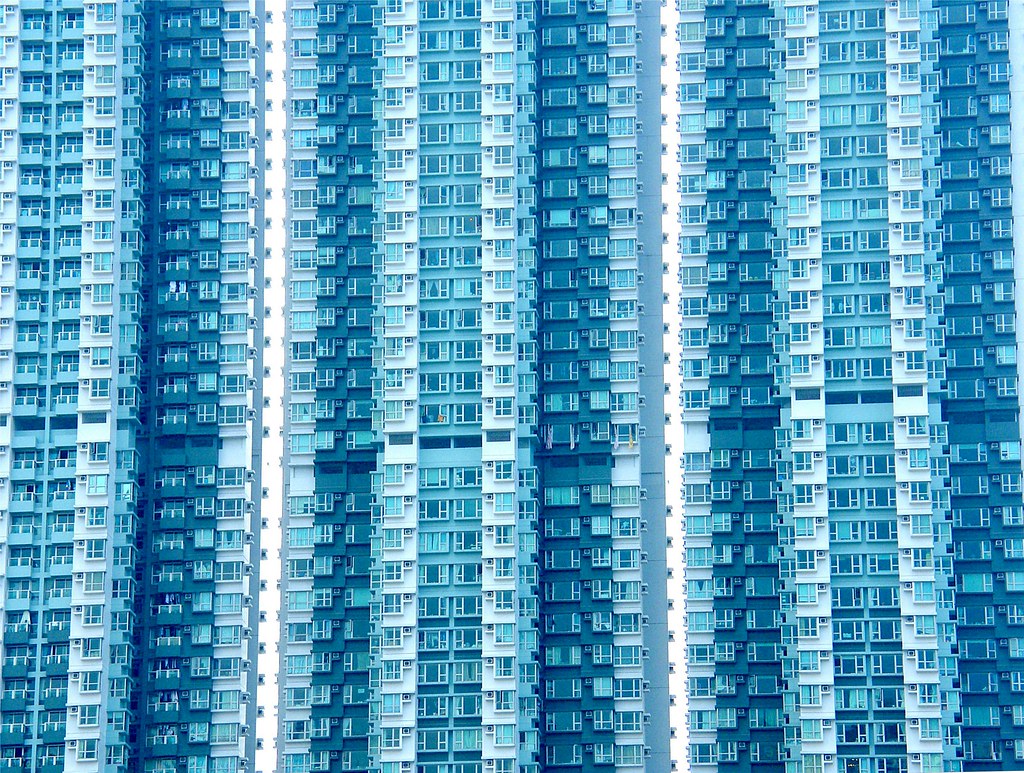

- Commercial property leasing

- Recommended option: joint and several guarantee

- Reason: common practice adapted to the risk

Combining additional guarantees often enhances protection. A surety bond can be accompanied by a security interest for optimum security.

Our firm can advise you on choosing and drafting the personal guarantee adapted to your situation. Contact us to secure your business relationships.

Sources

- Civil Code, articles 2287-1 to 2322

- Cass. com. 14 June 2023, no. 21-23.864 (on the principal's recourse after payment of an autonomous guarantee)

" `